Angel investing isn't just for seasoned Wall Street pros.

At the University of New Hampshire, you can fuel your entrepreneurial spirit with the Rines Angel Fund – a student-run private equity fund that offers a unique and practical learning experience in the world of angel investing and venture capital.

Most college finance clubs are all talk - analyzing case studies and practice portfolios. But UNH's Rines Angel Fund puts the money and responsibility in students' hands.

Real-World Investment Opportunities

The Rines Angel Fund isn't just a theoretical exercise; it's a hands-on program that immerses you in the exciting realm of early-stage investing.

Throughout the year, you'll have the chance to evaluate pitches from real start-up companies seeking seed funding. You'll conduct thorough due diligence projects, utilizing industry-grade tools to analyze potential investments.

And you'll collaborate with experienced angel partners, gaining invaluable insights and perspectives.

Develop Essential Skills for Success

Participating in the Rines Angel Fund will equip you with a diverse set of skills that will prove invaluable in any professional field you choose to pursue.

- Financial analysis and investment evaluation

- Critical thinking and decision-making

- Communication and collaboration

- Networking and relationship building

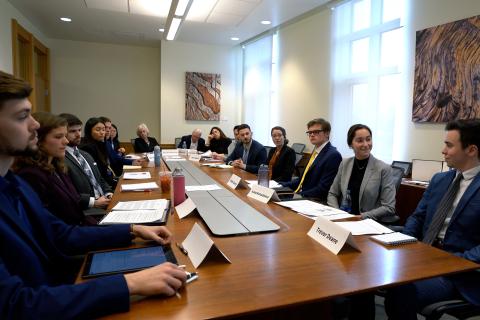

A Supportive and Collaborative Environment

As one of Paul College's unique class-clubs, Rines features the unmatched mentorship and guidance of Professor Jeffery Sohl, Associate Professor Jianhong Chen, and Program Coordinator Laura Hill. But it's also primarily student-driven, with an executive board and varying levels of responsibility based on your skills and experience

You'll work alongside a team of driven and passionate students, all united by a shared enthusiasm for entrepreneurship and investment. Together, you'll learn, grow, and challenge each other, fostering a healthy competition that encourages self-discovery and personal growth.

So, if you're a high school student eager to explore the world of angel investing and venture capital, the University of New Hampshire's Rines Angel Fund is the perfect opportunity. Join this dynamic program and take the first step towards an exciting and rewarding career in the investment world.

More information about the Rines Angel Fund, including the current team, current portfolio, insightful articles from students, and links to pitch or join the fund are available at their student-run website.

Rines Student Angel Investment Fund was established thanks to a contribution made by UNH Emeritus S. Melvin "Mel" Rines '47.